How Long Does It Take For A Check To Clear Bank Of America

How Does Depository financial institution of America Mobile Deposit Work and How Long Does It Accept?

- How Long It Takes

- Mobile Deposit Limits

- Mobile Deposit Fees

- How It Works

- Pros and Cons

- Choosing Mobile Deposit

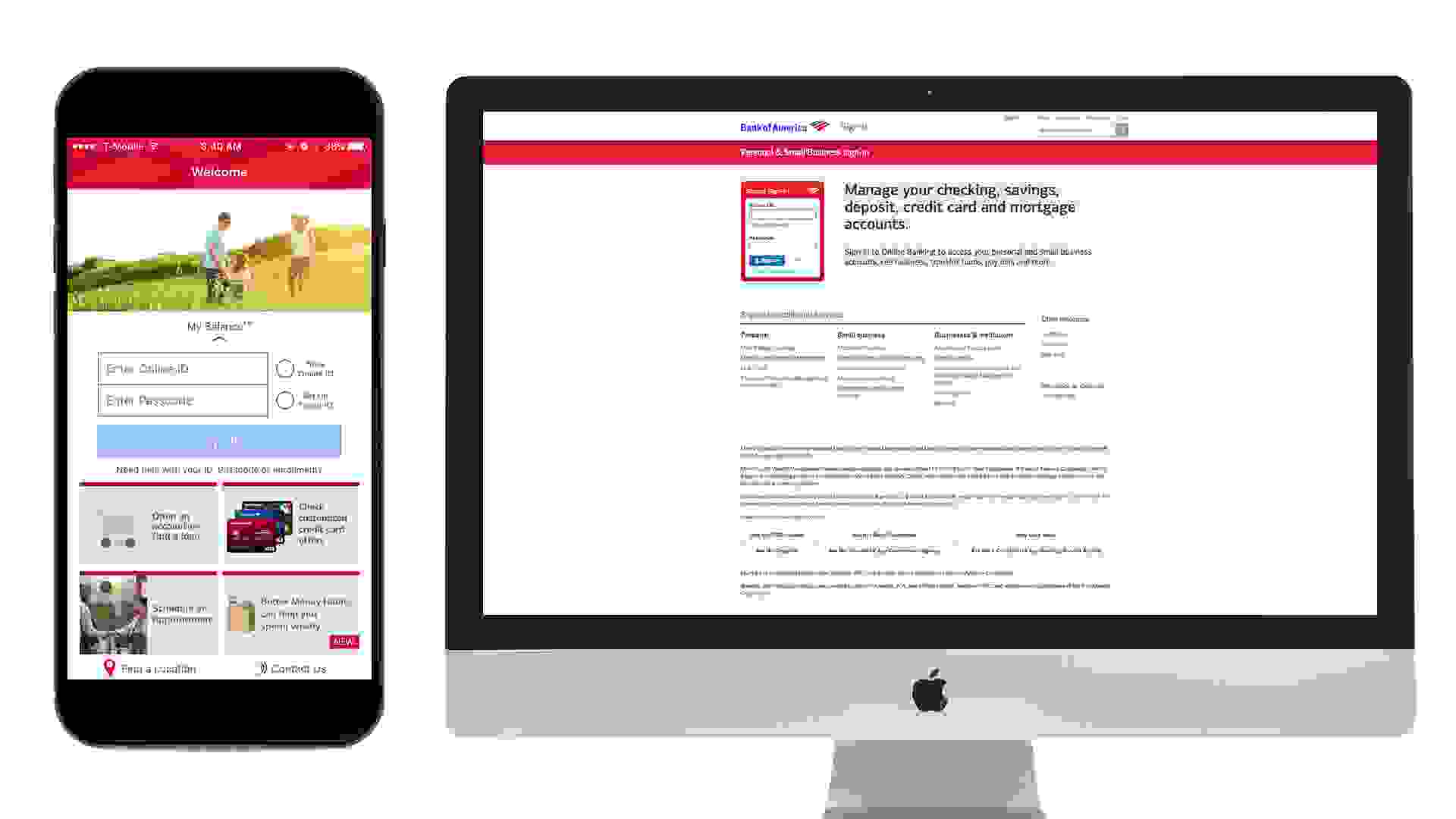

Bank of America mobile eolith makes information technology easy to add funds to your account using whatever device with a built-in camera. The mobile app lets y'all know when you've reached your monthly deposit limit. In almost cases, funds deposited by the 8 p.m. or 9 p.m. cut-off time are bachelor the next business day.

How Long Does Bank of America Mobile Deposit Have?

How long it takes for a Bank of America mobile eolith to hit your account depends on the time zone where your business relationship was opened, the type of deposit and when the deposit is made.

Cheque Deposits

Bank check deposits made before the cut-off time on a business organization day are commonly bachelor the following business organization twenty-four hour period. Cut-off times, based on time zones, are as follows:

| Time Zone | Cut-off Time |

|---|---|

| Eastern | 9 p.grand. ET |

| Primal | 9 p.chiliad. ET |

| Mount | eight p.m. PT |

| Pacific | viii p.m. PT |

| Accounts opened at financial centers in New Mexico, western Kansas and El Paso, Texas | 9 p.m. ET |

If, for example, y'all opened your account in the Eastern time zone and y'all eolith a check before 9 p.yard. on a Thursday, your funds will be available on Friday.

If you make the deposit later 9 p.m. on a Friday, your funds will be bachelor the following Tuesday. Deposits made on a Sabbatum or Sun will be available on Tuesday.

Deposits made on a federal vacation will striking your account on the showtime mean solar day following the next business day. If the holiday falls on a Mon, for example, your money volition be available on Midweek.

When Funds May Be Delayed

According to Depository financial institution of America's Deposit Agreement and Disclosure, there might be instances where funds availability is delayed. In those cases, you'll be notified by the adjacent business mean solar day. The get-go $225 of the deposited funds will be bachelor to you the next business day, still.

Special rules utilize to new accounts. During the first 30 days your account is open, funds from personal cheque deposits usually are available by the fifth business day afterward your deposit.

When you deposit certified or cashier's checks, or teller, travelers or government checks, the first $5,525 of each 24-hour interval's deposits are available before the second business organization day. The remaining funds are bachelor on the 5th business day afterwards the eolith.

Transfers

Transfers are handled differently from check deposits. Yous have immediate access to funds transferred into your account from another Bank of America deposit account.

However, when the transfer occurs later xi:59 p.thousand. ET on a business concern day, you won't run across it in your transfer history until the next day. Funds transferred on a Sat, Sunday or bank vacation will show in your transfer history on the side by side business organisation day.

Bank of America Mobile Deposit Limits

Bank of America, Member FDIC, imposes limits on total cheque deposits into your business relationship made via mobile deposit. The limits are based on the age of the account and your Banking concern of America Preferred Rewards membership condition.

The Banking company of America mobile check deposit limit is $10,000 per calendar month for accounts opened for three months or longer. For accounts opened for fewer than 3 months, the deposit limit is $2,500 per month.

For Depository financial institution of America Preferred Rewards members with membership for fewer than three months, in that location is a $25,000 per calendar month limit. For accounts with membership of three or more months, the limit is $50,000 per month.

Banking company of America Mobile Deposit Fees

At that place's a fee waiver for Depository financial institution of America mobile deposit. Notwithstanding, your wireless carrier might accuse messaging or data fees.

How Does Bank of America Mobile Deposit Work?

You lot brand mobile deposits using the Banking company of America mobile app, which is available on Google Play and the App Store.

Mobile App Features

On either platform, the app is a powerful tool non but for managing your accounts simply for organizing your finances as well. Hither are some of the things y'all can do:

- Review account action

- Check loan and credit card balances

- Transfer funds betwixt Bank of America accounts

- Transport coin using Zelle

- Pay bills and schedule neb payments

- Deposit checks

- Take advantage of special offers

- Stay on top of your upkeep with the spending and budgeting tool

The app features Erica, a virtual assistant who tin can help you lot use the app and send alerts with fiscal data and advice. You also tin can apply the app to contact customer service in the event you need live assistance or desire to schedule an appointment with an account specialist. Security features such as Touch ID and Confront ID protect your accounts against fraud.

Proficient To Know

You can deposit most types of checks online with Depository financial institution of America when y'all use the mobile app. Eligible cheque types are personal and business checks, cashier'south checks, and government and treasury checks.

How To Deposit Checks With Depository financial institution of America Mobile Deposit

Depositing checks requires just a few easy steps. Before y'all kickoff, detach the check from any stub or other paper. Then position the check then information technology lies flat on a dark-colored, fairly lit surface.

Step-by-Stride Guide to Bank of America Mobile Eolith

- Endorse the back of the check by signing information technology and writing "for eolith only at Bank of America" below your signature.

- Open the app and log in deeply using your fingerprint.

- Select the "Deposit Checks" link.

- Photograph the front and dorsum of the check with your smart device past selecting the "Front end of Bank check" and "Dorsum of Check" buttons in the app.

- Select the account into which you're depositing the bank check.

- Enter the amount of the deposit.

- Confirm the deposit details.

- Tap "Eolith."

In addition to depositing the bank check, you can utilise the app to save, print or email a copy of it.

Benefits and Drawbacks of Bank of America Mobile Deposit

Most users should find the Bank of America mobile deposit to be a valuable tool. But there are some drawbacks.

Benefits

- Bank check deposits are fast, complimentary and secure.

- Funds from cashier's checks and authorities checks are available the side by side business day.

- Customers can salvage, print or e-mail copies of the checks they deposit.

Drawbacks

- Funds from personal check deposits into new accounts aren't bachelor for 5 days.

- Mobile deposit isn't available for money orders, travelers checks or third-party checks.

- Bank of America imposes a monthly limit on cheque deposits. The app volition track how many deposits you lot have remaining.

Is Banking concern of America Mobile Deposit the Right Choice for You?

Bank of America mobile eolith provides a quick, easy way for customers to eolith money into their accounts. Although there are some exclusions to the types of checks you can eolith this way, the nigh common — personal, cashier'south and government-issued checks — are compatible.

That said, the bones mobile deposit capabilities are standard effect. What sets Bank of America's mobile app apart from other major bank apps are the virtual assistant and budgeting tool that can help you manage all aspects of your finances, and fifty-fifty schedule a face-to-confront meeting with an business relationship specialist.

Information is accurate equally of June 28, 2022.

Source: https://www.gobankingrates.com/banking/mobile/bank-america-mobile-deposit/

Posted by: wilsonankintly.blogspot.com

0 Response to "How Long Does It Take For A Check To Clear Bank Of America"

Post a Comment